The Wise way to handle money in Bali

Planning a trip to Bali and looking for a hassle-free way to handle money in Bali? Look no further than the Wise Travel Card. With its unbeatable exchange rates, convenient top-up options, and a range of user-friendly features, the Wise card is the perfect companion for your Bali travels.

When it comes to top tips getting a Wise card is on our top tier of recommendations whether you’re planning just a short trip or taking a longer break from life. Of the practical information that we give you on this site this is right up there.

Let’s dive into the world of Wise and discover why it stands out as the go-to choice for travellers (and us). Whether you’re seeking convenience, transparency, or cost-effective currency exchange it’s the Wise choice.

The Wise way to handle money in Bali:

Pros:

- Best exchange rates: Say goodbye to exorbitant currency conversion fees. The Wise card offers the best exchange rates, ensuring you get more bang for your buck.

- No annual fees: Bid farewell to those pesky yearly charges that eat into your travel budget. The Wise card is completely fee-free, leaving you with more money to enjoy your Bali adventures.

- Quick and easy top-ups: Whether you’re relaxing on the beach or exploring the lush jungles of Bali, topping up your Wise card is a breeze. With just a few taps on the Wise app, you can instantly load funds onto your card and get back to enjoying the island paradise.

- Low conversion fees: Wise believes in transparency, which is why their conversion fees are clearly labeled. You’ll never have to worry about hidden charges or surprises when using your Wise card.

- Preload multiple currencies: Bali is a gateway to a world of diverse cultures, and with the Wise card, you can embrace it all. Load up to 53 different currencies onto your card, allowing you to pay like a local in Bali and beyond.

- Card security: Losing your card while traveling can be a nightmare. But fear not! With the Wise app, you can easily freeze your card in case of loss or theft, ensuring your funds stay safe and secure.

- Track your spending: Bali offers endless temptations, from mouthwatering cuisine to vibrant marketplaces. To keep your travel budget on track, the Wise app lets you monitor your spending, helping you make informed financial decisions.

Wise to be Wise

The Wise card is the best option for foreign currency spending in 2023 for Bali.

10 million customers worldwide know that it is the Wise choice. Handle your money in Bali the Wise way.

Cons:

- Customer support: While Wise excels in many areas, some users have reported slower customer support response times. However, it’s worth noting that these instances are relatively rare and don’t overshadow the card’s overall benefits.

- No interest on balance: If you’re hoping to earn interest on your card balance, Wise isn’t the right fit. But hey, you’re here to enjoy Bali, not worry about earning interest, right?

- Withdrawal fees: Wise ensures your money stays in your pocket, but if you need to withdraw over $350 AUD from an ATM, an additional 1.75% fee applies. Additionally, after the first two free ATM withdrawals under $350 AUD for the month, a $1.50 fee is charged for each additional withdrawal.

Arrive in Bali knowing your money is in good hands

Imagine stepping off the plane in Bali, ready to soak up the sun, ride the waves, and immerse yourself in the rich Balinese culture. With the Wise card in your wallet, you can make the most of your time on the island. Leave behind the worrying about currency exchange hassles or excessive fees.

The Wise card, formerly known as TransferWise, revolutionises the way you manage your money abroad. It’s a prepaid debit card linked to your Wise multi-currency account. It offers seamless transactions, fast transfers, and unparalleled convenience.

So, how does it work? Well, it’s as simple as sipping a refreshing coconut on the beach. Just like a regular debit card, you can use your Wise card to pay for accommodations, meals, and shopping. The difference is in the exceptional features that Wise brings to the table.

With Wise, you have the power to load and hold up to 53 currencies in your account. This ensures that you’re always prepared for international transactions. The Wise card allows you to pay like a local, avoiding excessive conversion fees. Read up on the etiquette of tipping in Bali.

How does the Wise card work?

Adding money to your Wise card is a breeze. Simply open the Wise app, select the desired currency and amount, and choose your preferred payment method, such as a bank transfer or card payment. The flexibility and ease of the Wise app make managing your funds on the go a seamless experience.

One of the standout features of the Wise card is its ability to freeze the card via the app in case of loss or theft. We understand that accidents happen, and Wise ensures that your hard-earned money remains secure, even in the unpredictable moments of travel.

Tracking your spending is essential for maintaining a budget while exploring Bali’s wonders. With the Wise app, you can easily monitor your transactions, view your balance, and stay in control of your finances. No more worries about overspending or losing track of your expenses. The Wise app is your trusty financial companion.

But what about accessing your funds without your physical card? Wise has got you covered with virtual cards. Simply download the Wise app, and you can create up to three virtual cards linked to your account. These virtual cards work with popular mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay, allowing you to make secure and convenient transactions online, in-store, and even when exploring Bali’s hidden gems.

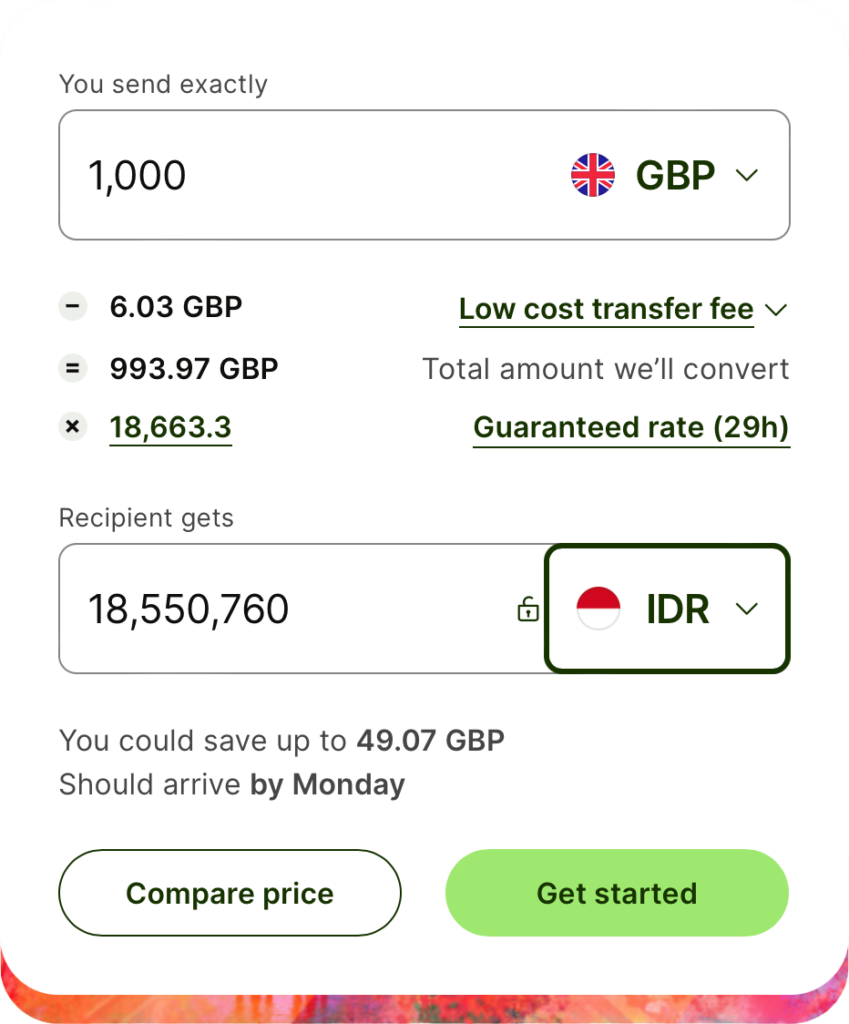

Save up to 9x when sending money abroad

Sending money shouldn’t cost the earth, so Wise is here to save you money when you transfer and exchange internationally.

How do I get a Wise card?

Applying for a Wise card is a straightforward process. Sign up for a Wise multi-currency account through their website or app, provide the necessary identification, and add a minimum of US$20 to your account. This amount covers the card issuing fees, and you’re all set to order your physical Wise card. While the delivery may take some time, the good news is that you can start using your digital card immediately, ensuring uninterrupted access to your funds while you wait.

When it comes to customer satisfaction, Wise receives accolades from millions of global users. With over 4 million travellers relying on Wise for their financial needs, it’s clear that the card’s benefits far outweigh any minor cons. The majority of users appreciate Wise’s competitive exchange rates, fee transparency, and the ability to seamlessly navigate the global financial landscape.

Wise is your goto travel companion. Say goodbye to hefty fees, ambiguous exchange rates, and financial worries. Wise empowers you by providing unparalleled convenience, transparency, and control over your finances.

As you embark on your Bali adventure, let Wise be your trusted partner in making every moment count. We use Wise almost everyday in Bali. It just provides a reassuring method for spending money. You can get ready to embrace Bali’s wonders with the Wise card by your side. Say hello to stress-free spending and bid adieu to money headaches. Wise makes your Bali journey truly extraordinary.”

Note: ThisBaliLife is not a financial advisor. This content is for illustrative purposes only and should not be considered as financial advice.